HAWK Advisers: Blog

Tech Trends in the Office – Enhancing Efficiency and Employee Experience

| What is AI? Artificial Intelligence, or AI, is the simulation of human intelligence used to develop dynamic solutions to queries or tasks. In the context of professional environments, AI encompasses a wide range of capabilities, spanning from the automation of...

Premiums Are Going Up – What Does That Mean For Me?

The steady rise of insurance premiums has become a growing concern, placing financial strain on individuals and businesses alike. This has left some questioning… Why is this happening? What factors are contributing to these changes?...

The Art That Shapes Roanoke

In the heart of Roanoke, Virginia lies a treasure trove of artistic marvels, waiting to be discovered and admired. With so many beautifully unique and wonderfully detailed murals, our downtown area is a testament to the thriving creative spirit that permeates our...

Ladder Safety: Do’s and Dont’s

When you think of dangerous tools and equipment, what comes to mind? Hammers, chainsaws, or nail guns are what most individuals determine when asked to identify the most perceptibly hazardous tools in a workshop or construction site. According to USClaims and OSHA,...

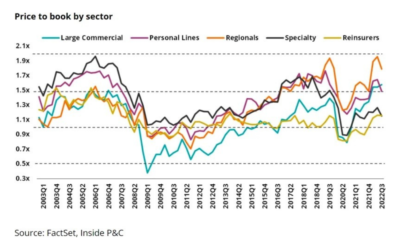

A Forecast Into 2023: What Does the Commercial Property & Casualty Market Outlook Mean for YOU?

As we head into 2023, the Property & Casualty (P&C) insurance market faces a range of both challenges and opportunities. This year’s report anticipates shifting economic conditions, changing regulatory requirements, emerging risks such as cybercrimes, and most...

Autonomous Insurance and the Future of Technology

Did you know that insurance agencies are implementing autonomous technology into their coverage agreement? Just as the transportation, home security, and retail industries are exploring autonomous features, the insurance industry is being upgraded with autonomously...

10 Takeaways from HAWK’s Area 51 Intelligence Briefing!

On October 11, 2022, HAWK Advisers hosted a seminar where Robert Garbee, Founder of Roanoke InfoSec Exchange (RISE) and Neely R. Conner, Director of Carilion’s Employee Assistance Program helped us storm Area 51, discussing the topics of Cyber Security and Mental...

Commemorating Sandy Hamilton’s Retirement

The last six months have seemingly traveled by at light speed since the announcement back in March that Sandy Hamilton is retiring on Friday, September 30th. This announcement is met with sentiments of heartfelt gratitude, sincere appreciation, and prayers for a...

2022 Theme: Next Level

Do you create a resolution or a goal for yourself every year? Do you have a theme song that helps inspire you and creates balance in your day? Just like the many ways people choose to motivate themselves throughout the day, HAWK Advisers began developing business...

In Loving Memory of Linda Simmons

It is with saddened hearts that we share the news of the passing of a teammate, friend, and member of our HAWK family. After courageously battling cancer, Linda Simmons passed away on October 24, 2021. Her memory will live on in our hearts and through her daughter,...

“New” Virginia Marijuana Law: Employer Guide & FAQ

Effective July 1, 2021, Virginia law prohibits an employer from discharging, disciplining, or discriminating against an employee for lawful use of cannabis oil based on a valid written certification. However, the law does not: • Restrict an employer's ability to take...

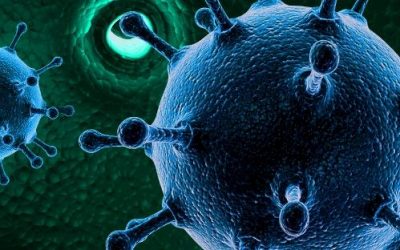

Managing Your Company’s Cyber Readiness

As we enter the third quarter of the year, recent news of cyber-attacks are capturing the attention from every corner of the globe. It's not a stretch to assume that everyone reading this blog post has in one form or another been party to a data breach. Within the...

HAWK’s Intern: A Year in Reflection

Background: My name is Will Matney, I started my internship at HAWK Advisers in September 2020 through the Blue Ridge Fellows after receiving my bachelor’s degree in Political Science from Virginia Tech. This program is one of many transitional initiatives in the...

2021 Theme: Stand in the Gap

Every year, our team at HAWK Advisers chooses a theme. In 2021, our theme is to “stand in the gap” for our clients, for our team and to serve as a reminder to the commitment we have to carry out our mission to the fullest. In ancient days, cities protected themselves...

OSHA: 300A Summary Deadlines

Annual OSHA 300A Summary Posting Deadline: February 1, 2021 OSHA's 300A Summary form records work-related injuries and illnesses recorded during the calendar year. Employer requirements include maintaining an OSHA 300 injury and illness log throughout the calendar...

What 2020 Taught Our Team at HAWK Advisers

2020 has presented some unforeseen challenges, but it has also given our team an opportunity to slow down, pause, and reflect on the lessons we have learned, the things in life that matter the most to us, and how our personal core values align with our core values...

Personal Umbrella Insurance: What It Is & What It Covers

As it tends to be with most things in life, interpretation does not always coincide with reality. Unsurprisingly, this principle could not be more true for what the insurance industry would call, “umbrella policies.” For many seeking to attain liability coverage,...

The Scary Truth of Not Having EPLI Coverage

What is EPLI Coverage? Employment Practices Liability Insurance is available to protect businesses for both first-party (employment related) and third-party (customer and vendor) lawsuits involving such issues as harassment or discrimination. Third-party liability...

Meet Will, HAWK’s Intern!

Who Am I? My name is Will Matney and I could not be more excited to be part of Team HAWK. In May, I received a bachelor’s degree in Political Science from Virginia Tech and wrapped up what ended up being the most transformative years of my life. While I spent the...

Do I Need Flood Insurance?

Flooding is common throughout many areas within the United States and can be prevalent during particular times of the year in particular areas. Though there is no specific flood season, most flooding occurs in the U.S. from spring to fall. Floods can cause more than...

Will Your Insurance Cover Workers’ Compensation & Business Interruption Claims Due to the Coronavirus?

The coronavirus has taken the world by storm, disrupting businesses around the world and changing how we live our daily lives. Social distancing is in full effect as schools, sporting events, and other activities are being shutdown to help mitigate the spread of...

How Does a Workers’ Compensation Claim Affect My Premium?

One of the biggest expenses affecting small businesses is workers' compensation insurance, which covers expenses associated with injuries to employees while on the job. Workers' compensation is one way that small business employers can help protect the people that...