Did you know that insurance agencies are implementing autonomous technology into their coverage agreement? Just as the transportation, home security, and retail industries are exploring autonomous features, the insurance industry is being upgraded with autonomously advanced features as well. With dynamic technologies, insurance agencies are able to provide coverage through unique and unexpected ways!

Robotic Process Automation (RPA) is a service implored by insurance groups to build a “high-growth responsive business while optimizing the cost,” effectively improving the accuracy of claims, premiums, policies, etc. (Makadia).

RPA is one way that technology is redefining how we view insurance with AI robotic processing, an autonomous feature that improves the intake of information and the dispensation of analytical data. With this innovative augmentation, insurance groups can process claims faster through autonomous analyzation, a feature which can streamline their processes and considerably reduce the time it takes to complete said tasks.

Like most, you might be saying to yourself that “this is too invasive,” or “I don’t want my insurance company to know all of this information,” a common sentiment held by those questioning the legitimacy of the speed-to-value of such technologies. The percentage of users who choose to assimilate automation with their current coverage is lower than 20%, according to McKinsey & Company. Who wouldn’t find the invasion of privacy excessive?

As an independent agency, we act as a resource for our clients by consulting with them before opting-in or opting-out of any automation services that fit their personal preferences. At HAWK, we strive to provide you with confidence in your coverage, giving you peace of mind in knowing that you and your assets are protected from potential risks and unexpected events.

But, do you know how this technology is reflected through routine? Information created by users in their day to day lives allows insurance companies to provide more accurate and personalized insurance, leading to lower insurance premiums and the overall safety of the customer. Likewise, insurance companies like HAWK have policies and procedures in place to ensure the privacy and security of customer information even when using automation technologies.

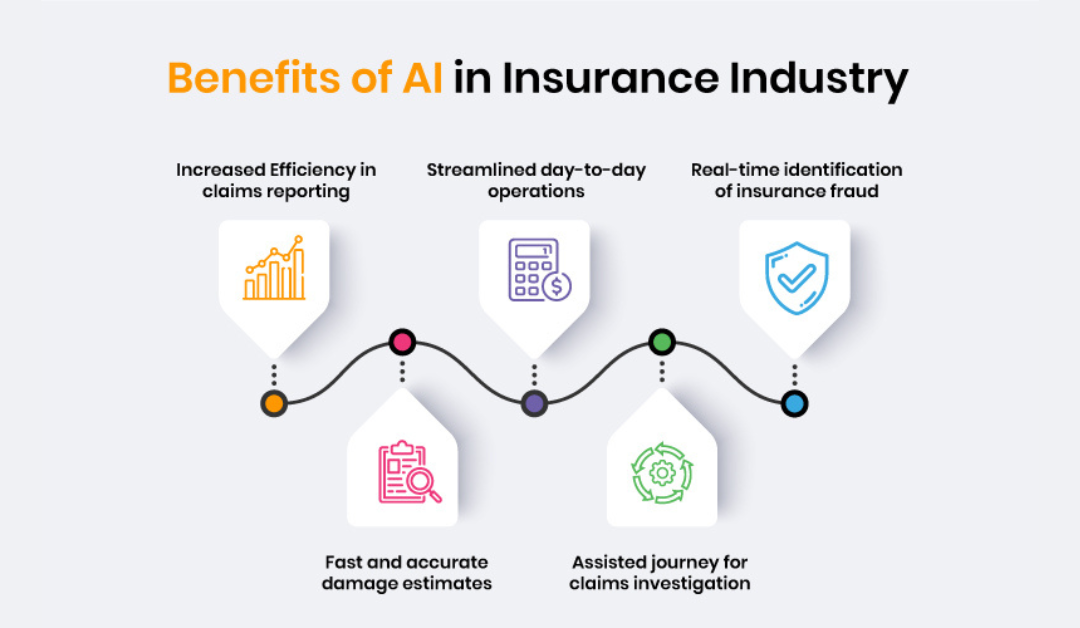

So… in what ways do insurance providers accurately and adequately furnish coverage for the insured? Here are four unique ways automation and technology are utilized in the insurance industry:

- Telematics in cars: Sensors collect data and metrics by measuring speed, acceleration, braking, and location. By collecting this data, insurance companies are able to better understand how an insured driver behaves on the road and thus calculate personalized insurance rates and policies. Sensors are also used in water, alarm or home security systems to quickly detect potential accidents.

- Wearable technology: Medical technology allows an insurance company to gather more accurate information about an insured’s lifestyle and healthy habits. Not only do these smartwatches or fitness trackers improve the coverage of individuals, they also incentivize healthy living alongside personalized policies.

- AI and ML: Artificial intelligence (AI) and machine learning (ML) are two features that assist insurers with claims processing, fraud detection, and underwriting processes. These capabilities improve the speed and accuracy in which customers receive policies, claims, or other services.

- Predictive analysis: The data collected on individuals isn’t limited to the creation of their current policies, but their future ones as well. Predictive analytics use data in statistical analysis and ML processes to identify and predict risk based on past events or circumstances.

However, what does this technology do to relationships? Not only can these up-and-coming technologies enhance speed, but they can also improve the process by which insurers analyze their relationship with insureds. Automatized services are able to analyze the demographical characteristics of users as well as collect various data that ultimately encourages improved habits in exchange for lower rates from their insurance agencies. Such technology helps the development of seamless coverage that benefits the insurers and insured alike.

So, what does this mean for YOU? How do you fit into the growing tech involved in the insurance industry? To summarize…

- Your connectivity equates your ability to be insured: Sharing data improves customer support, the processing of claims, and an overall personalized experience tailored to you.

- Protection in multiple areas: Automation and advanced technology protects you against fraud or any form of malfeasance through data processing.

- Faster processes for you and your insurer: Technology is able to accelerate the process of claims reporting, investigation, estimation, and identification of various material. In other words, automation accounts for the right solutions in a shorter amount of time.

Recent Comments